In recent years, the trend of digital transformation is taking place strongly in many businesses. In the context of the Covid 19 epidemic, the work location and timekeeping changed. Thereby requiring each organization to be more flexible in salary management. Apply Employee payroll software seems to have become a familiar tool for many businesses.

Why should you use payroll software?

Payroll management using Excel is a very popular option. Although it allows to set up many complex formulas, it is not completely optimal. Because a complete payroll will require a lot of data. Basics such as: Worksheet file, List of personnel and salary, File bonuses and allowances; File fines, salary deductions; Vacation tracking file; Relative tracking file; Insurance file; Personal income tax file; File tracking salary advances, salary debt...

To aggregate all the data, it would take a C&B specialist several days to complete the payroll for about 100 employees. Not to mention manual operations that are prone to errors. They take another 1-2 days to check and correct. It takes a lot of time and effort! Slowing down the salary payment progress of the enterprise, affecting the working experience of employees.

In addition, making payroll in Excel has other potential dangers. Does not guarantee security; Poor integration; Distributed data, difficult to make comprehensive reports. Not to mention sometimes the owner's interpretation will be difficult for other members to understand. Or cannot leave "inheritance" to the next person; Not scalable;…

Manual salary calculation method also causes difficulties for other members. Specifically:

- Managers are difficult to grasp due to scattered, inaccurate data, lack of timely reporting

- Employees have to wait until the end of the month to see payroll. While there are too many data fields, when there are errors, it takes time to email questions and explanations.

For that reason, many businesses have converted from calculating salaries in excel to salary calculation solution automatic. A suitable software will help businesses save a lot of time, costs and effectively manage data.

What criteria to choose payroll software?

There are many on the market right now payroll software heavily advertised. Choosing the right solution for your business is not easy. Even if you choose the wrong solution, it is difficult for the software to completely meet the needs of the business. Thereby pushing the business into a state of "dilemma". Half-hearted modernization, waste of money and manpower. Here are the basic criteria for software selection:

Full and automatic salary calculation

Currently, the software on the market can be divided into 2 types: overall software from records management, time attendance, salary calculation, .. and separate payroll software.

For separate payroll software, consider the ability to connect with other systems that the business is using. For example, timekeepers, HRIS data management systems, etc. to get payroll input data. Or KPI, CRM, social insurance and tax management systems to accurately calculate final income.

While, HR management software, time attendance and salary calculation Overall, it will cover many business operations of the business. Because each business will have its own characteristics in terms of salary calculation, bonus and penalty regulations, salary formula, etc.

A good software is one that can centrally manage data to form payroll. From timekeeping data, tax deductions, social insurance, allowance levels. Until salary fluctuations, overtime, overtime, allowances, etc.

Flexibility to meet the company's salary rules

Every business has a different way of operating. The difference in working hours, shift division, OT regulations, etc. makes the complexity of timekeeping and pay multiplies. Each industry and field of activity will have its own peculiarities. It's normal for a piece of software to work well at one business and fail at another.

Payroll software needs to be able to customize formulas. Especially when personnel regulations, management regulations can change according to the growth of the business. In addition, each business will pay wages weekly, monthly or daily.

Cloud-based software is often developed in packaged form. So not all software can be flexible and customized for each business. When businesses find out an online payroll software, should pay attention to the supplier's customers, the areas they have deployed. Along with that, give your specific salary calculation problem to evaluate the response level of the solution. Thereby making the correct selection decision.

Reporting system for managers

With salary calculation, businesses need a lot of reports such as: salary fund report, tax report, social insurance increase and decrease report, etc. So a good software also needs a detailed reporting system to support it. each department, each employee object. The chart report system will help businesses manage and track more easily and intuitively. At the same time, it supports the comparison of data over a specific time period.

Payroll software with high data security

Payroll is always an important and sensitive data of a business. When choosing software, businesses should pay attention to the supplier's capacity factor. Are they specialized and capable of securing data in the event of an attack? Binding requirements and commitment to compensate when risks occur.

In addition, the delegation of authority in the organization is also very important. A good software will allow decentralized members to join and edit payroll data. Similarly, the software should have elements such as building a tight editing and approval process.

Team to support payroll software system

Choosing to buy a software often comes with the business not having a strong enough IT team in terms of expertise. Therefore, it is difficult for them to quickly deal with technical problems. If possible, businesses should choose a supplier who is willing to provide free technical support to customers.

In addition, during use, there will be times when the software has an error from the system. Or the business needs to change its policy on salary, bonus, contribution rate, regulations, formula. Vendors with continuous support will help businesses deal with changes faster. As well as timely handling when problems arise.

The difference of CoffeeHR . Payroll Software

It is a very specialized HRM Cloud solution

CoffeeHR is a cloud-based human resource management solution developed by OOS Software. Capital is a unit with more than 10 years of history building HRM solutions for many large enterprises such as: Bibica, Ecopark, Lotte, SHB, Th True Milk, King Mattress. CoffeeHR solution can meet the overall problem for businesses, not only calculating salary, but also managing from Recruitment, HR Profile, Integration and Retirement Management, C&B Management (time attendance, salary calculation. , tax, social insurance), Training and evaluation management, Providing HR services.

High customizability of CoffeeHR . payroll software

Unlike cloud solutions on the market that are developed individually, or packaged in 100%, CoffeeHR is built on the basis of a business framework summed up from the process of implementing many complex HRM projects. Therefore, the solution can solve many specific public and salary problems of many fields. CoffeeHR allows customizing salary formulas, regulations, and C&B processes specific to each business.

Currently, CoffeeHR is the Cloud solution that handles many of the most complex C&B problems on the market.

API integration capabilities

API stands for Application Programming Interface. This is an intermediary method that connects different applications and libraries.

It provides access to a set of frequently used functions. From there it is possible to exchange data between applications.

As analyzed, payroll operations require multiple data fields from multiple systems to complete payroll. For example, many businesses apply KPI salary calculation based on revenue for sales staff. Or they pay commissions according to each specified level of sales. Payroll software needs to be able to connect with sales management system to receive final data. That is the sales per employee to calculate salary KPI.

With CoffeeHR, the software has a two-way open API, so it can connect to many other systems. For example: CRM system, DMS system, GPS (location management, timekeeping), online social insurance system, ... Not stopping there, OOS Software (CoffeeHR solution developer) also have experience connecting with many systems of business administration. For example, the ERP ofSAP solution (TH True Milk project), Oracle Netsuite (Vuong Mattress project, Citicom, Getfit), ... to form the overall operation management system.

Experienced deployment and support team

As a unit specialized in developing HRM solutions, it is understandable that CoffeeHR has an experienced team. This facilitates when businesses choose CoffeeHR. You can rest assured with solution implementation capabilities.

With its experience, CoffeeHR not only provides software solutions. That will advise businesses to build processes, apply methods suitable to their industries and fields.

Not only that, CoffeeHR has its own support team 24/7. Ensure technical factors, processing time arising during use

Specifically, what can CoffeeHR payroll software do?

Build formulas and automatically calculate payroll

An extremely rich set of default variables combined with customizable information fields, helps businesses build salary formulas in the most flexible and convenient way. Excel formulas are installed easily and quickly. Then the automatic calculation system will reduce the error rate and save time.

Businesses can completely adjust the salary formula themselves when there are changes in the use process or CoffeeHR's support team can support that.

Automatic aggregation of data to create payroll

As an overall platform, CoffeeHR easily aggregates accurate and fast data:

- Synthesize data on basic salary, contractual allowances from the human resource management module

- Data synthesis Timekeeping: timetable, work symbols, GPS timekeeping, summarizing coming late and leaving early, regulations on rewards and punishments, working shifts, application for explanation, etc. to calculate the final paytable and transfer to salary data .

- OT synthesis and OT data dissection. For example, OT on weekdays, Saturdays, Sundays, holidays, night OTs... and similar formulas

- Aggregate data on leave, compensatory leave, business trips, etc.

- Synthesize evaluation data to calculate salary KPI,...

- Management of salary fluctuations: salary increase or decrease, transfer, appointment, etc.

From there, CoffeeHR will become Payroll management software for HR and has the ability to track any fluctuations. It's not just about data collection and payroll completion. In addition, information about relatives and number of dependents will automatically calculate personal income tax and transfer it to the payroll right on the software.

CoffeeHR manages the fluctuations of increase and decrease of insurance such as: maternity leave, return to work after maternity leave, salary increase, transition from probation to official status, leave or unannounced leave beyond the prescribed time. determine, change in insurance premium rates, etc. to issue alerts on the software, adjust data and transfer to payroll.

Handle complex payroll problems

Not just Product Payroll Software, working day, hourly, ... CoffeeHR can handle more complex salary problems according to the characteristics of industries and businesses:

Salary KPI:

Many businesses are applying KPI payroll, but most of the Cloud solutions on the market have not built KPI evaluation and transferred the results to payroll. Conversely, an organization can set CoffeeHR to KPI payroll software. As follows:

- Allows setting and customizing criteria KPI assessment according to the needs of each business

- Set the formula and output the results as parametric (A,B,C), percentage or point format.

- Link with payroll to calculate commission, calculate KPI salary, ...

KPI is also the third factor (P3) to calculate 3P salary.

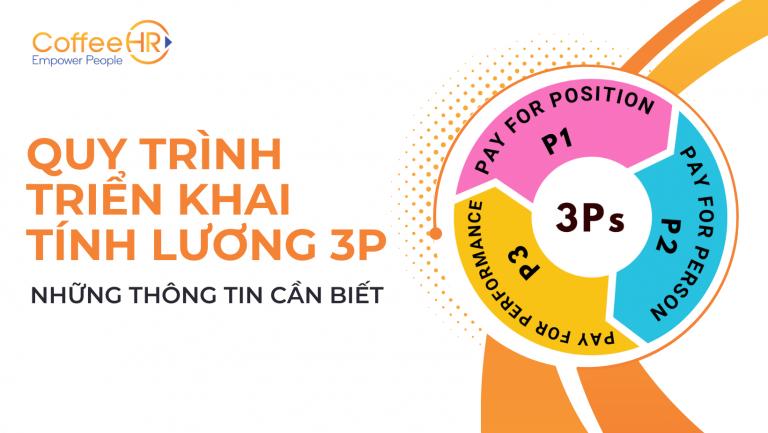

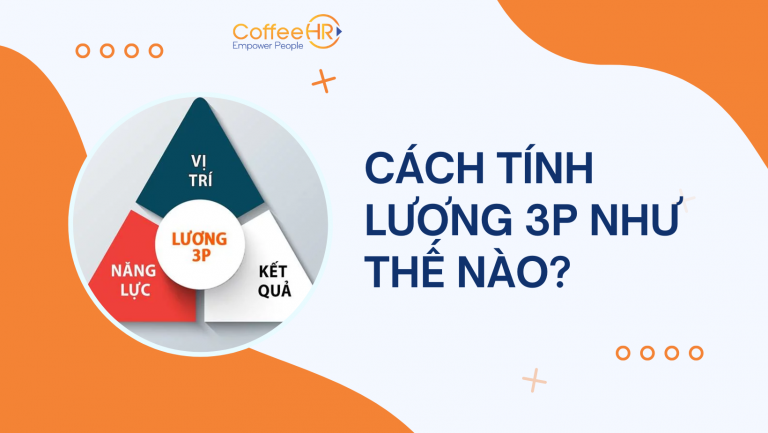

3P salary:

More and more businesses are applying the 3P salary payment method to employees. 3P salary is a salary evaluation system based on 3 main factors:

– Pay for Position: Pay according to job position (P1). Businesses use a fixed amount to pay a monthly salary for a position, regardless of who the person is and how capable.

With P1, CoffeeHR allows setting salaries according to job position. Businesses can easily adjust or install formulas, the software will automatically calculate to give payroll.

– Pay for Person: Pay based on ability (P2) Enterprises rely on the competency assessment framework to pay salaries to employees.

CoffeeHR has built in-depth and capacity evaluation criteria, formed management spider charts to easily track employee capacity. The output data of the competency assessment will be converted into the input of the payroll based on the pre-set formula.

– Pay for Performancee: Salary based on results. (P3). The employee's bonus will be paid based on work performance. What criteria do they meet the company's criteria? What benefits do they bring to the business?

Part-time salary:

Part-time pay is applied when an employee is in charge of 2 jobs or positions at a company or group. Most are holding models or chain stores.

The most difficult thing when dealing with part-time salary is the tax and social insurance factors. Especially when managing on software.

With CoffeeHR, the software can disassemble the data field to calculate tax and social insurance. From there, two different payrolls were formed. But still very convenient to track and export reports.

Split salary

When do payroll splits appear? Is when that pay period has employees who split the salary stream due to changes such as:

- Changes in salary such as a decision to increase salary, decrease salary, change in job position leading to salary change...

- Change of contract from probation to official

When there are these changes, taxes and social insurance will also change. With the usual excel method of calculating salary, C&B employees need to keep track of a lot of data files. Such as contract file, list of personnel and salary, transfer of appointment, etc. Sometimes information is missing, incomplete update will lead to errors in calculating salary, tax and social insurance.

With CoffeeHR, the software will manage data fluctuations. Form 2 salary lines and run tax and social insurance data right on the same payroll. Make it easy for employees to keep track of without much effort. But still ensure high accuracy.

Provide detailed payroll and issue pay slips

- CoffeeHR allows to create payroll and payment cycle information depending on the needs of the business

- Aggregate data, display payroll directly

A detailed payroll needs to be full of data. From basic salary, daily salary, insurance premium, tax deduction. Until salary commission, bonus, salary advance, food. Thanks to this payslip, businesses and employees themselves can follow up on time.

- Payroll information will be displayed and emailed to each employee.

Employees can directly view detailed salary slips at the portal. Inquiries about personal salary calculation are quickly recorded and forwarded to C&B staff. Saving time, not worrying about distance is the convenience of CoffeeHR.

- Payroll lock feature and decentralization: make it easier for businesses to manage

- Support manual payroll adjustment. If there is a problem that requires manual adjustment, all edit history is saved. At the same time, employees will be notified of this adjustment. For businesses with special allowances and unexpected bonuses, C&B employees can easily update their payroll through the import feature.

Reporting system on CoffeeHR . Payroll Software

CoffeeHR allows auto-generating report insights from system data. It can be the total amount of salary the business has paid to employees for the month. Includes total taxes and insurance paid. Or the correlation between the numbers between departments, the average number of employees, etc. In addition, payroll software CoffeeHR can compare payroll costs with sales to provide profit metrics. From there, the administrator can payroll management organization better and make informed decisions.

END

Automating the payroll process will bring a lot of sustainable value to the business. During the implementation process, the organization should consider the criteria and features of the solutions. Besides, there are future expectations and software productivity.

CoffeeHR payroll management software with preeminent features will help businesses improve complex processes. Cutting back on manual work doesn't just increase HCNS performance. It also saves money and increases the employee experience in the organization. With many years of experience, good implementation team, short setup time and reasonable cost, CoffeeHR is the right choice. Regardless of whether your business encapsulates 30 employees or 300 employees.

CONTACT US

CoffeeHR has more than 10 years of accompanying many businesses and corporations. Contact now to optimize administration for your Business.

Hotline: (+84) 97 306 0459

Facebook: CoffeeHR – HR Coffee