Salary is always a "sensitive" issue that employees and businesses are concerned about. Every company needs to build a good and appropriate salary policy. An effective salary system not only helps businesses retain talent but also increases revenue. Let's consult CoffeeHR with how to calculate salary basic, most accurate through the article below.

Current popular payment methods

Currently, the most popular payment methods are applied by many businesses such as:

- The form of payment according to the hours worked

- Form of payment according to business turnover

- Form of payment of contract salary

- The form of payment based on the product can be made

Details of the payment methods are as follows:

How to calculate hourly wage

Hourly salary is calculation salary according to the actual hourly working time of the personnel on the enterprise's time sheet. This calculation is based on rank, title and allowances, often or other insurance that employees receive.

There are actually 2 salary calculation formula The most basic applies to businesses:

Method 1:

| Salary = | Basic salary + | allowance (if any)/standard workday x | Actual number of working days |

Employees will not have too many questions with this salary calculation. Because each day of unpaid work is a fixed deduction. How many days off, how much money is deducted. If there is no change in salary, employees will be entitled to the full salary as prescribed if they work full days as prescribed.

For example, a company has a policy of working from Monday to Friday and two Saturdays, we will have 24 official working days in May. So 24 days is the number of administrative days.

Method 2:

| Salary = | Basic salary + | allowance (if any)/26 x | Actual number of working days |

With this salary calculation method, the monthly salary will not be fixed because the standard working day of each month is different. Employees need to consider which month to take unpaid leave to balance wages and living costs. However, businesses will suffer a lot of impacts on productivity and business activities because employees often ask for leave in months with many working days.

Example to compare 2 salary calculation methods:

Method 1: Negotiable salary is 9 million per 26 working days, employees go full 26 working days:

9,000,000/26 x 26 = 9,000,000 VND

Method 2: The agreed salary is 9 million per 26 working days but the actual working day of employee A is 24 days:

9,000,000/26X24=8,307.692 VND

How to pay salary according to business sales

How to calculate salary? This usually applies to sales staff, sales staff, consultants, etc. based on the staff's efforts. This method helps to encourage and motivate employees' self-discipline a lot because their salary / bonus depends on the company's sales. Applying this way helps businesses reduce budget risk in case of bad results.

♦ Formula for calculating salary by sales:

| Monthly salary = | Basic salary + | Commission percentage x | Revenue generated by HR in the month |

Payment methods such as:

- Salary/bonus based on personal sales

- Salary/bonus based on group sales

- Other forms of bonus: debt, market development, etc.

How to calculate contract salary?

This form is applicable to seasonal jobs. Employees will receive salary after completing a volume of work in accordance with the quality and time assigned.

Salary formula:

| Wage = | Contract salary x | Rate of % work completed |

In this method of salary, enterprises are allowed to use contracted contracts to work and offer benefits how to calculate employee salary accordingly. After receiving the results of work handover, the contracted party is responsible for paying remuneration to the contracted party as agreed.

Pay based on the product you can do

This is how to calculate worker's salary according to the quality, quantity of products and completed work in order to closely associate remuneration with labor productivity. This form has the effect of encouraging employees to increase labor productivity, contributing to increasing the number of products and revenue.

Salary formula:

| Wage = | Number of products x | Product unit price |

Currently, the salary calculation method is used by most businesses to properly meet the capacity of employees as well as motivate them to work more.

Calculation of leave salary and salary for Tet holidays

How to calculate leave salary

If the employee is at fault in the contract, the enterprise does not need to pay the remaining wages to the employee. If the enterprise is the party at fault, it is required to pay the salary in accordance with the signed contract.

If due to natural disasters, epidemics. If you leave the business location or due to electricity, water, etc., the salary is based on the agreement of the two parties as follows:

- The leave salary is not allowed to be lower than the minimum salary specified in the labor contract in case the employee stops working for less than 14 days.

- How to calculate salary? quit one's job be agreed by both parties to ensure that the minimum wage is not lower than the minimum wage in case the employee stops working for more than 14 days.

Calculating salary and bonus for Tet holidays

According to the provisions of the Labor Law, during the New Year and Lunar New Year holidays, employees are still entitled to 100% salary. This rule also applies to the following holidays:

- Liberation of the South April 30: 1 day off

- International Labor Day 01/05: 1 day off

- National Day September 2nd: 1 day off

- Hung Kings Anniversary 10/03 Lunar calendar: 1 day off

In particular, foreigners working in Vietnam will be entitled to 01 day off on National Day and traditional New Year of their country. Holidays with full pay will be decided and announced annually by the Prime Minister. So businesses need to update the latest changes to apply to their company.

How to calculate 13th month salary

Depending on the business situation and policies of each business, the how to calculate salary bonus The 13th month is not mandatory.

Conditions for an employee to be rewarded with 13th month salary:

- The probationary period is over

- Working continuously for at least 01 month or more, up to the end of December 31 (solar calendar) of that year

- Still working at the company on December 31 of that year

The 13th month salary is not calculated for employees who have not finished their probationary period by December 31 of that year.

♦ How to calculate 13th month salary:

Employees working full 12 months from January 1 to December 31 of the solar calendar:

| 13th month salary = | Average total salary/12 months |

Employees working for less than 12 months in the year up to December 31st of the calendar year:

| 13th month salary = | (Total monthly salary + allowances if any) | /12 x | Actual number of months worked in that year. |

Watch more videos Payment methods

Principles of employee compensation

Salary deadline

Wages are paid after the hour, day, or week of work if the employee chooses to be paid by the hour, day or week. Depending on the agreement of the two parties, the employee can also choose to pay the lump sum in the condition that 15 days must be paid in lump sum. Employees will be paid semi-monthly or once a month.

For salary calculation formula According to the product, according to the contract, it will be according to the agreed term of the two parties. However, the employee can advance the salary for the month based on the volume of work if the work has to be done for many months.

Principles on how and when to pay wages

Either way, your employees must be paid on time and in full. In case of non-payment on time, the enterprise needs to pay the employee at least one month in advance along with an amount equal to the bank interest rate announced at the time of salary payment.

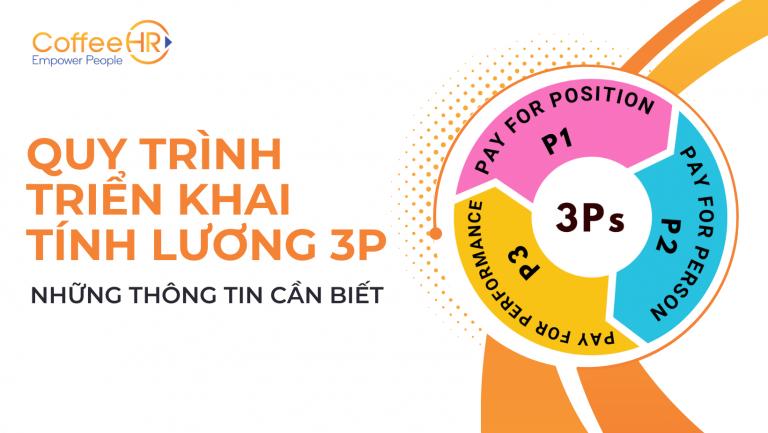

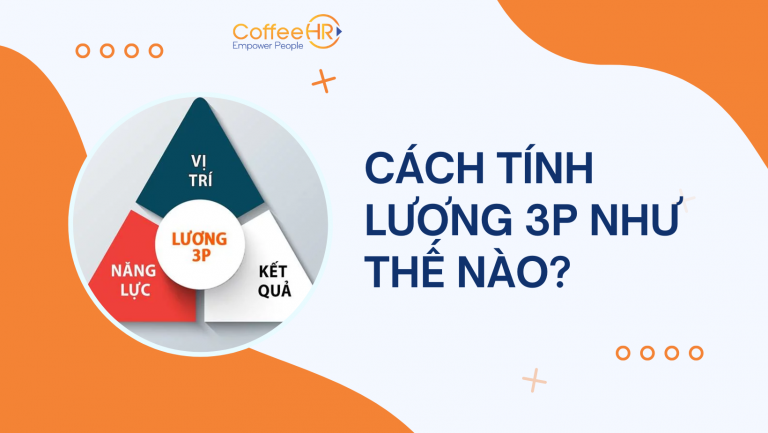

Depending on the position and business situation of each enterprise, different payment methods can be applied to be appropriate and fair to employees. The current, how to calculate salary 3P is very effective and popular in the Vietnamese market, applied by many businesses.

How to make Excel payroll for employees

Guide how to make payroll for employee

- Column 1: “STT”

- Column 2: “First and last name”: You enter the employee number and name. (according to the timesheet list).

- Column 3: “Title”: You enter the position of each employee. (You can get information on the contract or the personnel tracking sheet if you have one).

- Column 4: “Basic salary”: The lowest level as the basis for enterprises and employees to negotiate and pay wages.

Conditions for application of regional minimum wages:

– Not lower than the regional minimum wage for employees doing the simplest jobs.

– At least 7% higher than the regional minimum wage for employees who do jobs requiring workers who have undergone vocational training or vocational training.

– For employees who are in the probationary period, the probationary salary must not be lower than 85% of the official salary. (Article 28 of the Labor Code)

- Columns 5, 6, 7: “The allowances do not pay insurance”: Overtime, phone, petrol, …

- Column 8: “Liability Allowance”: This is an allowance for insurance premium calculation.

Note: Depending on each company, there are other allowances for paying insurance such as title allowance, seniority allowance ... for you to create more columns in the payroll.

(The allowances are usually specified in the labor contract, so you get the data in the contract, in case the contract does not specify the specific benefit level, you should base on the salary and bonus regulations, the company finances for data)

- Column 9 : “Total income” = Column 4 “Basic salary” + Column 5,6,7 “Extra allowances not paid for social insurance”.

- Column 10: “Working day”: Based on the timesheet to put the data here.

If there are New Year holidays in the month, the provisions of Article 115 of the Labor Code 2012.

- Column 11: “Actual total salary” = (Column 9 “Total income”/number of working days as prescribed)* Column 10 “workdays”.

- Column 12: “Salary paid for social insurance” = Column 4 “Basic salary” + Column 8 “Responsibility allowance”

- Columns 13, 14, 15, 16: “Salary deductions for employees” = Column 12 “Salary for social insurance contributions” x Rate of deduction according to salary.

- Columns 17, 18, 19, 20: “Family deductions”, “Other deductions”.

- Column 21: “PITable income” = Column 11 “Actual total salary” – Allowances without PIT.

- Column 22: “PIT taxable income” = Column 21 “PITable income” – Deductions (Column 16 + Column 17 + Column 18 + Column 19 + Column 20).

- Column 23: "PIT".

- Column 24: “Advance”: is the salary the employee has advanced in the month.

- Column 25: “Real performance” = Column 11 “Actual salary” – Column 16 “Deductions from salary” – Column 23 “PIT” – Column 24 “Advance”.

Employee payroll automation software – CoffeeHR

In recent years, the trend of digital transformation is taking place strongly, the use of software calculate employee salary seems to have become a familiar tool for many businesses to ensure fairness, accuracy, saving costs and human resources.

In particular, CoffeeHR payroll software is chosen by many businesses because of the experience accumulated over 10 years in implementing complex C&B projects for leading enterprises in the industry. Some outstanding advantages of CoffeeHR are:

- Allows businesses to customize their own salary formulas according to organizational changes

- CoffeeHR is the first On cloud Payroll Software that solves the most complex salary problems: KPI salary, 3P salary, part-time salary, split salary, seniority salary, variable salary unit price,...

- Automatically summarizes public data accurately and quickly such as: timekeeping date/time, leave, leaving late, leaving early

- Two-way open API connects to many other systems that support payroll such as: CRM, ERP, online social insurance tax, ...

- Tax and insurance support

- CoffeeHR payroll software allows creating in-depth reports from system data to help administrators easily manage the organization's salary fluctuations and make accurate decisions.

- Issue detailed pay slips to employees

Currently, CoffeeHR is the Cloud solution to handle many of the most complex C&B problems on the market. To learn more about this payroll software, you can refer to the article here.

END

CoffeeHR hopes that the information in this article can be useful, helping businesses to choose and build how to calculate salary suitable for attracting and retaining talent. At the same time, help businesses develop in the right direction and achieve the goals they have set.

CONTACT US

CoffeeHR has more than 10 years of accompanying many businesses and corporations. Contact us now to get a salary calculation software consultation for your business.

Hotline: (+84) 97 306 0459

Facebook: CoffeeHR – Human Resources Coffee